Get Your Fuel Tax Refund

+$600 on average

No installation necessary

Register Your Business

First answer a few questions about your business and set up an account

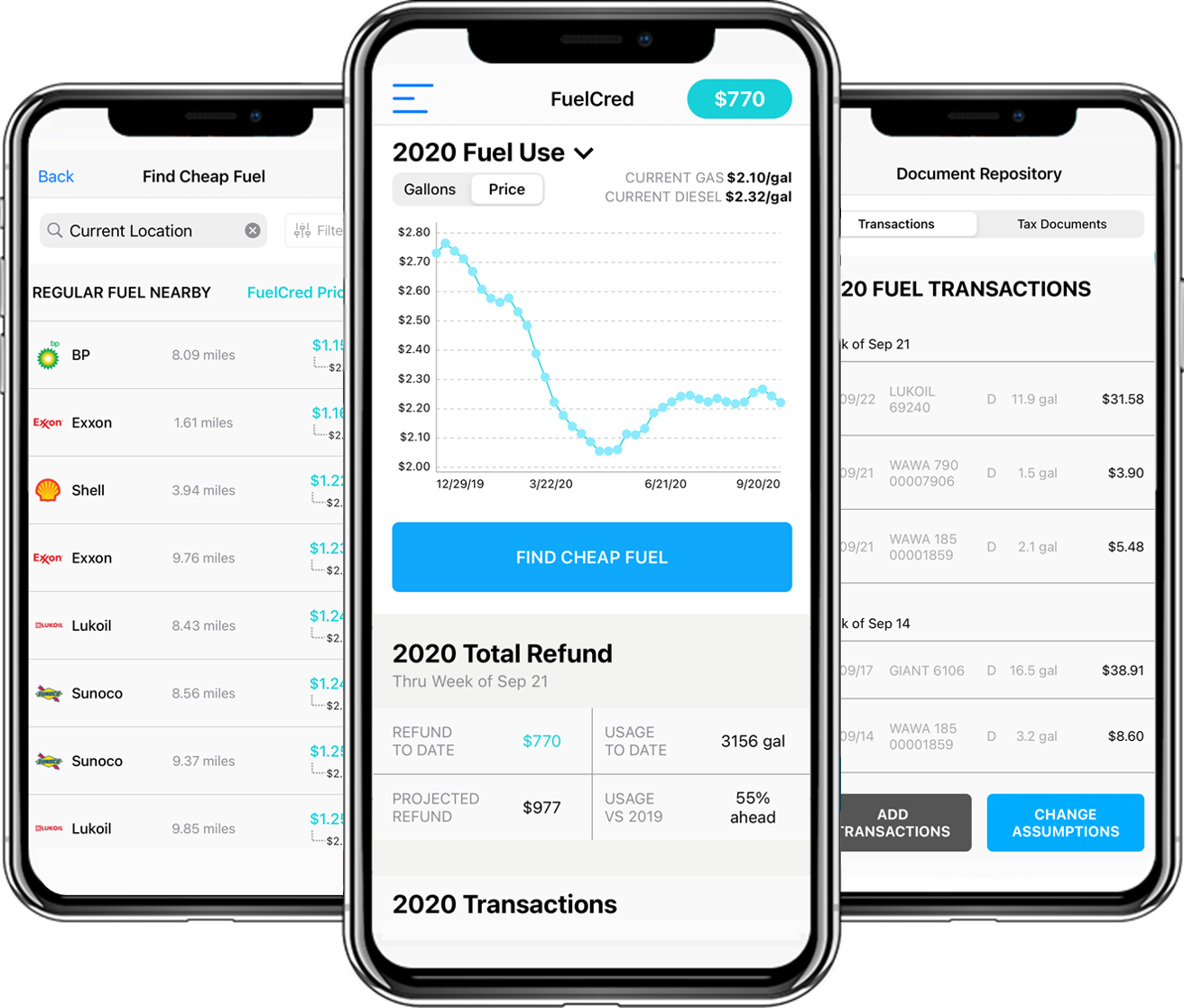

Find Cheap Fuel

FuelCred finds cheap, local fuel options by projecting your per-gallon tax savings

Get Your Refund

FuelCred generates the IRS form and forwards it to your CPA- and you get paid

How FuelCred works...

Meet The Team

Consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolor tempor incididunt ut labore dolore magna.

Frequently Asked Questions

The federal government and most states add a special tax to ALL fuel (e.g. gasoline, diesel) purchased at retail gas stations. This “fuel tax” is used to pay for the maintenance of roads, bridges and public transportation systems. Businesses that use fuel for “off-highway” purposes (i.e. in equipment not meant to travel on roads or highways) are eligible for a “credit” or refund of these fuel taxes. This refund is called a “fuel tax credit” or “fuel tax refund”.

If you own a business, no matter how big or how small, that uses fuel for “off-highway” purposes (i.e. in a lawn mower, generator, tractor, etc.) then your business would be eligible for a federal fuel tax refund/credit.

FuelCred is a mobile app that automates the process of claiming the federal fuel tax refund/credit. FuelCred monitors, analyzes, and keeps track of fuel purchases made with your business credit card, calculates your fuel tax refund, produces the proper form to legally request your refund from the IRS, and forwards this form to you or your tax preparer/CPA. FuelCred helps users save up to 40% on fuel.

Fuel savings are a combination of deducting your fuel business expense and receiving a fuel tax refund/credit. For example, if a gallon of fuel costs $1.00 and your effective tax rate is 20%, you’d save $.20 from your fuel business expense deduction and about $.20 from your fuel tax refund. So you’re only really paying $.60 for that gallon of fuel!

Simple. Click here.

The “FuelCred price” is an individualized, per-gallon calculation of how much you’re actually paying for fuel after taking into account your distance to a given gas station, your estimated fuel business expense deduction, and your estimated fuel tax refund.

In general, the cheapest “FuelCred price” will be the best/cheapest overall option for a given location or job site.

Any business that uses fuel for “off-highway” purposes should apply for this credit.

Examples include landscaping businesses, hardscaping businesses, farmers, construction firms, equipment dealers/suppliers, etc.

If you use fuel in your business then it’s worth applying for the refund. The federal government charges a tax of 18.4 cents on every gallon of gasoline and 24.4 cents on every gallon of diesel. Many states have even higher fuel tax rates. The average refund due to users of FuelCred is $600+/year.

You would receive about $100 for every 540 gallons of gasoline or 410 gallons of diesel you use for “off-road” business purposes.

The federal fuel tax credit can be claimed by using IRS Form 4136, “Credit for Fuel Tax Paid on Fuels”. If you subscribe to FuelCred, the completed Form 4136 will be automatically generated and forwarded to you, your CPA, and/or your tax preparer to be included in your regular income tax return (1040) that you file annually with the IRS. If you owe taxes, the fuel tax refund will be used to directly offset any taxes you owe. If you don’t owe any taxes the fuel tax refund amount will be added to the tax return check you receive from the IRS.

Not with FuelCred. When you connect your business credit card to FuelCred it automatically tracks your fuel transactions and applies the proper tax rules. Additionally, a subscription to FuelCred typically costs only a small fraction of the overall expected fuel tax refund for subscribers.

“Off-highway” business use means fuel that is used in a trade or business that is not used on a public highway by a registered vehicle. A public highway includes any road in the United States that isn’t a private roadway. This includes federal, state, county, and city roads and streets.

Example: Caroline owns a landscaping business. She uses power lawn mowers and chain saws in her business. The gasoline used in the power lawn mowers and chain saws qualifies as “off-highway” business use. The gasoline used in her personal lawn mower at home or the truck she uses in her business does NOT qualify as “off-highway” business use.

Probably not. We asked CPAs who typically service landscapers if they filed for federal fuel tax credits on behalf of their clients. Only about 10% even knew that the credit existed and only about 1% had filed for the credit on behalf of their clients.

YES. At the end of the year when you request your tax documents, FuelCred will forward the completed IRS fuel tax credit form to your CPA to be included in your annual filing.

Unlike a “tax deduction”, a “tax credit” is a 1-for-1 reduction in taxes for businesses. So even if a business doesn’t owe any taxes, the IRS will send an eligible business a check for any fuel tax refund owed.

Unfortunately, NO. FuelCred can only be used by businesses that purchase taxable fuel.

The IRS Form 4136 for the previous tax year (2020) is typically released in January/February of the subsequent tax year (2021).

Please feel free to reach out to the FuelCred team at info@fuelcred.com