Whether you’re a new or an established business, reviewing your business entity structure is an important consideration. Your business entity structure affects how much you pay in taxes, the paperwork you need to file, your personal liability, etc. Additionally, as your business grows from a one-man crew into a business potentially operating across state lines with multiple employees, selecting the right business entity structure can have a major impact on your bottom line.

Types of business entities

According to the IRS and the Small Business Administration, there are five common business structures to choose from:

- Sole proprietorship

- Partnership (General, Limited, or Limited Liability Partnerships)

- Limited Liability Company (LLC, Single-member or Multi-member)

- Corporation

Based on our conversations with business owners who use FuelCred, two of the more popular business structures are Single-Member LLCs and S-Corporations (S-Corps). These two structures are actually very similar in nature. Both share the following characteristics:

- Liability – Unlike sole proprietorships, Single-Member LLCs and S-Corps offer limited liability for each business partner/member. Each partner/member is only liable for their share of the business – creditors cannot go after the partner’s personal assets or income.

- Taxation – Both entities offer the concept of pass-through taxation. Pass-through taxation means that all of the income from the business venture “passes through” to the individual personal taxes of the partners/members. You’ll have to file the corresponding informational tax form (Form 1065 or 1120s) with the IRS, but the business will not owe any taxes at the business entity level.

- Compliance Requirements – Unlike sole proprietorships, which don’t have separate filing requirements, Single-Member LLCs and S-Corps have federal and state filing requirements. Additionally, your business is subject to certain state laws, such as having to appoint a registered agent, file annual reports, and pay annual fees. Here is an external link with a breakdown of the annual fee per state by entity type.

So, you’re probably asking yourself, why should I select an S-Corp vs. a Single Member LLC or vice versa. The biggest difference between the two structures is the treatment of salary/compensation for business owners. It’s no surprise that businesses are required to pay income tax on business earnings. However, only one of the two business structures requires payment of self-employment tax on the entire amount of business earnings.

As a brief refresher, self-employment tax is a tax levied on the net earnings from self-employment activities. This rate is a combination of Social Security and 2.9% Medicare taxes, 12.4% and 2.9%, respectively. W-2 employees have this tax taken out of their paycheck each pay period.

Self-employed individuals (sole proprietors & partnerships) must calculate and remit their share of self-employment tax each quarter. If you operate as a Single-Member LLC and elect to be treated as a partnership, you’ll have to pay self-employment tax on your net profits (this is considered your net earnings). The good news is half of the 12.4% for Social Security tax (6.2%) is deductible on your partnership tax return as this is considered a valid business expense.

However, S-Corps are allowed to classify a portion of their business income as salary and the other portion as a distribution. The salary portion is still subject to self-employment tax and personal income tax, however the distribution portion is only subject to personal income tax and not self-employment tax.

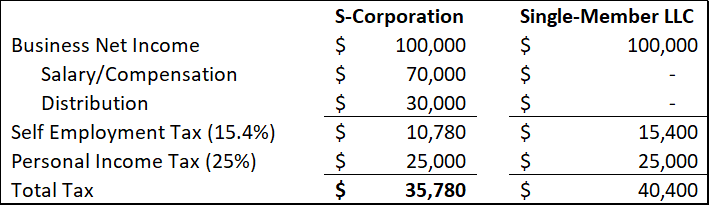

For example, if your business made $100,000 in net income and is structured as an S-corp, the owner could take a salary of $70,000 (as long as it’s reasonable) and have a distribution of $30,000. The self-employment tax would be applied to the $70,000 resulting in a $10,780 self-employment tax bill. If you were operating as a Single-Member LLC, your self-employment tax would be $15,400.

So why don’t S-Corp business owners classify all of their income as a distribution and forgo the self-employment tax? IRS regulations state that S-Corp owners must pay themselves a “reasonable compensation” before they can classify income as a distribution. The IRS does not fully define “reasonable compensation” for business owners, however you can check out the IRS website for more guidance on this topic.

Keep in mind that S-Corp filing fees are generally more expensive than Single Member LLC filing fees. Also there are some requirements that are unique to S-Corps (view those here), but many small business landscaping and farming businesses will meet these requirements.

As the 2020 season comes to a close, make sure you review your business entity structure from a tax standpoint and confirm you’re taking advantage of the various options out there for business owners.

FuelCred does not provide tax advice and this blog post cannot be relied upon as such. Please consult a CPA and/or other qualified professionals who understands your business before making any change to your business entity structure or tax filing status.